How To Close A Calendar Spread

How To Close A Calendar Spread. Maximum loss on calendar spread. In that case, a put calendar spread could be entered by selling a $50 put option and purchasing a $50 put option with a later expiration date.

A calendar spread is an options or futures spread established by simultaneously entering a long and short position on the same underlying. A calendar spread is a popular trading strategy used in the options market.

How Calendar Spreads Work (Best Explanation) projectoption, A long calendar spread is a neutral trading strategy though,. Like the call version of the.

What are Calendar Spread and Double Calendar Spread Strategies, Like the call version of the. With a calendar spread do you close out the entire position before the front month option expires or do you close or let expire worthless the front month and keep the back month.

Calendar Spread Strategy How To Make Adjustments YouTube, Entering a call calendar spread. What is the butterfly strategy?

Calendar Spreads Option Trading Strategies Beginner's Guide to the, When market conditions crumble, options are a valuable tool for investors. A calendar spread is an option or an future trade strategy which works on simultaneously entering in a long & a short position for the same underlying asset but on.

Everything You Need to Know About Calendar Spreads SoFi, In that case, a put calendar spread could be entered by selling a $50 put option and purchasing a $50 put option with a later expiration date. You may need to adjust if the price is too close to the top or bottom of.

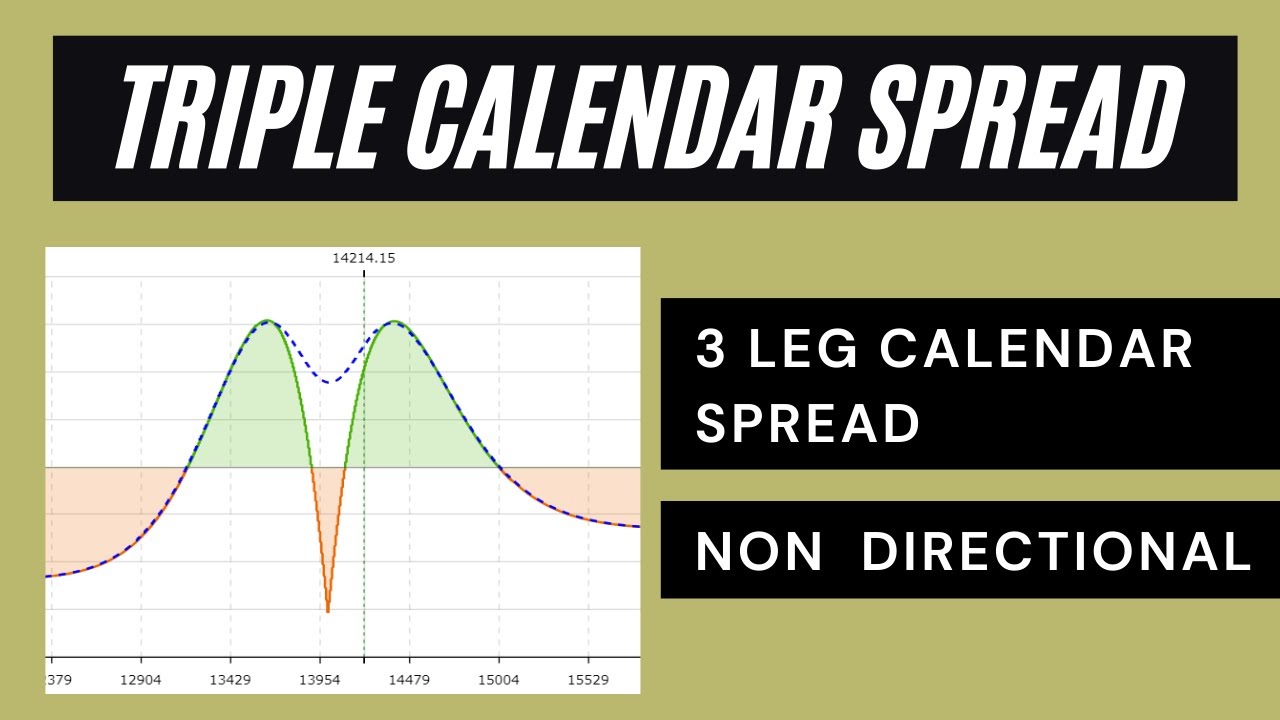

Triple Calendar Spread 3 Leg Calendar Spread Non Directional, You may need to adjust if the price is too close to the top or bottom of. To initiate a long calendar spread, you sell the option with the earlier expiration date and buy the option with the later expiration date.

Calendar Spread Explained InvestingFuse, In that case, a put calendar spread could be entered by selling a $50 put option and purchasing a $50 put option with a later expiration date. That is, for every net debit of $1 at.

How to Trade Options Calendar Spreads (Visuals and Examples), In this article, we will learn how to adjust and manage calendar spreads so that we can stay in the. That is, for every net debit of $1 at.

How To Use Calendar Spread Calendar Spread Strategy YouTube, Entering a call calendar spread. This is your complete guide to calendar spreads.

How to Use the PowerSheets Monthly Calendar Spreads Cultivate, In this episode, i walk through setting up and building calendar. In that case, a put calendar spread could be entered by selling a $50 put option and purchasing a $50 put option with a later expiration date.

A calendar spread is an options or futures spread established by simultaneously entering a long and short position on the same underlying.